Squeeze play (baseball)

"In baseball, the squeeze play is a maneuver consisting of a sacrifice bunt with a runner on third base. The batter bunts the ball, expecting to be thrown out at first base, but providing the runner on third base an opportunity to score. A bunt can be attempted with two outs but it is uncommon because there is a significant chance that the batter would be thrown out at first base, ending the inning. Likewise, such an attempt is unlikely with two strikes because a bunt attempt that is fouled off is an automatic third strike. The squeeze play is said to have been invented on the baseball field at Yale by George B. Case, who later went on to found the white-shoe law firm White & Case.[1]

In a safety squeeze, the runner at third does not take off until the batter makes contact bunting, waiting for more certainty that the ball will go to a location from which it will be difficult for the fielding team to make an out at home plate.

In a suicide squeeze, the runner takes off as soon as the pitcher begins to throw the pitch, before releasing the ball. If properly executed, a play at home plate is extremely unlikely. However, if the batter fails to make contact with the pitch, the runner is likely to be put out at home plate (hence, "suicide"). Therefore, the suicide squeeze usually requires a skilled bunter who can make contact consistently, even on difficult pitches.

These plays are often used in the late innings of a close game in order to score an insurance, winning or tying run."

In order for the above play to be executed with success, it takes practice, skills, preparation and timing. And although success is not guaranteed, teams will attempt the play for a variety of reasons (some noted above) as part of their strategy for winning the game.

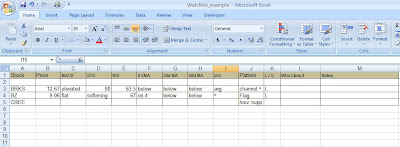

When compared to stock trading, there are a lot of similarities for traders to follow. However, for this post I wanted to focus on the something quite relevant: the Bollinger Band squeeze play. Below is an example of a chart showing a severe tightening of the Bollinger Bands on the Daily chart for AIG (American Internat Group):

As you can see, the upper and lower Bollinger Band have constricted the price into a VERY tight range. What attracts me to this setup is the expected outsized move out of this tight range - it could be up or down. Price moves out of these squeeze patterns are usually significant and thus provide a good Risk / Reward in my opinion.

In a safety squeeze, the runner at third does not take off until the batter makes contact bunting, waiting for more certainty that the ball will go to a location from which it will be difficult for the fielding team to make an out at home plate.

In a suicide squeeze, the runner takes off as soon as the pitcher begins to throw the pitch, before releasing the ball. If properly executed, a play at home plate is extremely unlikely. However, if the batter fails to make contact with the pitch, the runner is likely to be put out at home plate (hence, "suicide"). Therefore, the suicide squeeze usually requires a skilled bunter who can make contact consistently, even on difficult pitches.

These plays are often used in the late innings of a close game in order to score an insurance, winning or tying run."

In order for the above play to be executed with success, it takes practice, skills, preparation and timing. And although success is not guaranteed, teams will attempt the play for a variety of reasons (some noted above) as part of their strategy for winning the game.

When compared to stock trading, there are a lot of similarities for traders to follow. However, for this post I wanted to focus on the something quite relevant: the Bollinger Band squeeze play. Below is an example of a chart showing a severe tightening of the Bollinger Bands on the Daily chart for AIG (American Internat Group):

As you can see, the upper and lower Bollinger Band have constricted the price into a VERY tight range. What attracts me to this setup is the expected outsized move out of this tight range - it could be up or down. Price moves out of these squeeze patterns are usually significant and thus provide a good Risk / Reward in my opinion.

In scanning for these patterns, just instruct your scanning software to look for stocks that have an upper Bollinger Band that has been decreasing for 5 days, and a lower Bollinger Band that has been increasing for 5 days. Obviously you can play around with those settings to expand your results list.

Another example from a trade today was with MILL (Miller Petroleum). Here is an updated chart showing the up move:

Although the stock printed a massive Shooting Star on this Daily chart, the point here is that the move out of the Bollinger Band squeeze was significant.